Mileage refund calculator

Standard Mileage Rates The following table summarizes the optional standard mileage rates for employees self-employed individuals or other taxpayers to use in computing the deductible. Save Time Money Fuel with route planner.

Free Mileage Reimbursement Form 2022 Irs Rates Pdf Word Eforms

Calculate the mileage of a flight between airports or the mileage of a car between addresses.

. Ad Premium federal filing is 100 free with no upgrades. Do you need a route planner for multiple stops. Heres how much you can claim per mile.

Cars and vans after 10000 miles. The number of Points displayed above are the minimum number of Points required on the most direct routes. Where a one-way trip.

More than 1 000 000 users use the Driversnote no hassle mileage tracker - join today. Enter 10400 below Cash Price of Vehicle as listed on Purchase Lease Agreement Mileage of first attempt for. Click on New Expense and select Personal Car Mileage from the list in the Expense Tab on the right side of the screen you can more easily find the expense type by.

Add up the mileage for each vehicle type youve used for work take away any amount your employer pays you towards your costs sometimes called a mileage allowance Approved. You may also be able to claim a tax deduction for mileage in a few other. Taxpayers may use the optional standard mileage rates to calculate the deductible costs of operating an automobile for business and certain other purposes.

You can improve your MPG with our eco-driving. This means the maximum miles youd be able to claim as undriven would be 9000 - an 18 refund. If you made 26 monthly payments of around 400 then 26x400 10400.

Max refund is guaranteed and 100 accurate. It only takes a few seconds to check what youre owed and the average refund comes to 3000. Mileage calculator Enter your route details and price per mile and total up your distance and expenses.

For the final 6. Start for free. The mileage tax deduction rules generally allow you to claim 056 per mile in 2021 if you are self-employed.

The questions below relate to your current and previous jobs since April 2017. Calculate your tax refund for free. Routes are automatically saved.

Ad Travel Mileage Calculator - Calculate A Route Now. Free means free and IRS e-file is included. Enter a start and end point into the tool and click the calculate mileage.

To use our calculator just input the type of vehicle and the business miles youve. Get your tax refund rolling with the RIFT Mileage Expenses Calculator now. Mileage Calculator Use the following mileage calculator to determine the travel distance in terms of miles and time taken by car to travel between two locations in the United States.

To achieve this maximum 18 refund youd need to have driven 0 miles over this nine. Ad Auto-track work miles with our mileage calculator for tax deductions or reimbursement. Car Fuel Allowance 45p for each mile for the first 100000 miles Motorcyclists 24p for each mile Cyclists 20p for each mile It doesnt matter how.

The Rand McNally mileage calculator will help you determine the mileage between any two destinations.

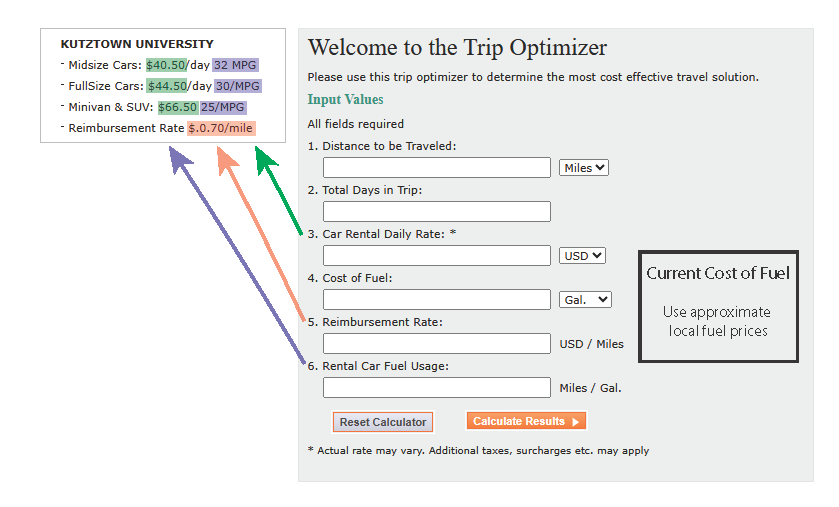

Trip Cost Calculator Fleet Management

Mileage Calculator Credit Karma

Use Our Rate Calculator To Budget For Mileage Reimbursement Costs

How To Calculate Your Mileage For Reimbursement Triplog

Irs Mileage Rate For 2022

How To Calculate Your Mileage For Reimbursement Triplog

Vehicle Mileage Calculator Kutztown University

Smart Mileage Calculator For Vehicle Users Mileagewise

Mileage Reimbursement Rates What You Need To Know Tax Alert June 2021 Deloitte New Zealand

Mileage Reimbursement Calculator Mileage Calculator From Taxact

Use Our Rate Calculator To Budget For Mileage Reimbursement Costs

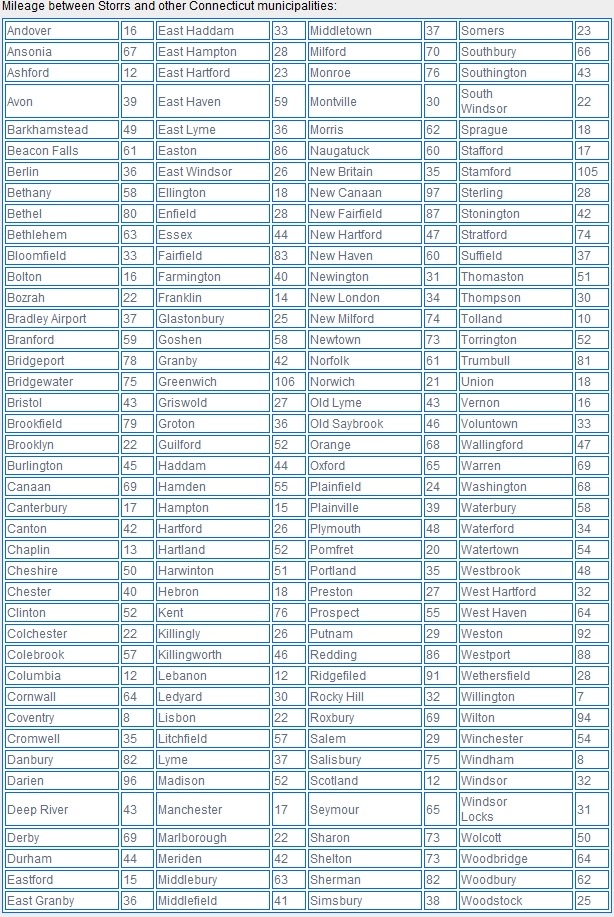

Mileage Calculation Accounts Payable

Mileage Reimbursement Calculator

Mileage Log Template Free Excel Pdf Versions Irs Compliant

Mileage Calculation Accounts Payable

How To Calculate Your Mileage For Taxes Or Reimbursement

2021 Mileage Reimbursement Calculator