Taxes off a paycheck calculation

I moved to the United States this year. This method is the one most commonly used by small businesses.

Here S How Much Money You Take Home From A 75 000 Salary

And he cited Bloombergs philanthropic giving offering the calculation that taken together what Mike gives to charity and pays in taxes amounts to approximately 75 of his annual income.

. What is the tax rate on my income subject to US. Until we reckon with our compounding moral debts. For example when an employer pays you an annual salary of 40000 per year this means you have earned 40000 in gross pay.

Sixty years of separate but equal. Federal estate and gift tax in Reminders. Make sure you send both the taxes you withheld from the employees paycheck and the taxes you owe as the employer.

The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. It is not a substitute for the advice of an accountant or other tax professional. If viewing in Workday use the scroll bars on the side and at the bottom of the section to scroll through the list if you have a large number of earning types for the pay periodIf viewing in PDF or on paper this section may be.

This includes amounts you earmark for use in or in connection with influencing specific legislation. It is a noncash expense that. You might also be required to claim tax credits like the Earned Income Credit or for one-off events like the Recovery Rebate Credit the payments better known as stimulus checks.

Can I deduct my moving expenses on my US. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for California residents only. It is not a substitute for the advice of an accountant or other tax professional.

Amid this daily grind its easy to put retirement savings on the back burner especially when its 15 20 or 30 years off. QuickBooks annualizes the wages on a paycheck and if the annualized wages are small federal or state withholdings can be correctly calculated as 000 even when prior paychecks for the same employee. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Comprise any federal income taxes and state or local taxes imposed in the region by the government and regulatory authorities. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time.

You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. NW IR-6526 Washington DC 20224. All expenses you reimburse to employees should be paid in full and added on to net pay at the end of your calculation.

An expense that indicates the reduction in the value of fixed company assets. The gov means its official. Before sharing sensitive information make sure youre on a federal government site.

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Florida residents only. See State or local tax credit and State or local tax deduction earlier. If you have federal income taxes withheld from your paycheck the only way you can receive a tax refund when too much was withheld is if you file a tax return.

Contributions from which you receive or expect to receive a credit or deduction against state or local taxes unless an exception applies. Between January 1991 and January 2016 a five-year certificate of deposit CD that was rolled over every time it matured could have earned 767 528 558 392 157 and 086 that is less than 1. The 50 calculation represents the half-year convention for assets not in service the entire year.

For example if the gross pay is 2000 and the paycheck is for 1500 they may assume 500 went to taxes. The earnings section details out every type of earning you have received during this pay period and your YTD totals. It is not a substitute for the advice of an accountant or other tax professional.

However the truth is a bit more complex. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. It is not a substitute for the advice of an accountant or other tax professional.

Two hundred fifty years of slavery. Other factors that can affect the size of your paycheck in California or in any other state. When itemizing taxes before 2018 you may remember hearing about the 2 rule This rule meant that taxpayers who couldnt write off certain expenses related to their jobs were allowed to deduct a portion of those itemized miscellaneous expenses that exceeded 2 of their Adjusted Gross Income AGI.

In reality interest rates fluctuate. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Texas residents only. It lets you take a larger deduction in the first few years and a smaller write-off later.

Indeed surveys have repeatedly shown that the average American retirement savings is too low and that significant numbers of Americans in their 30s 40s and even 50s have no retirement savings at all. Second the calculation assumes a steady interest rate over the span of approximately 25 years. From fashion editorials to tax advice.

Overview of Illinois Taxes Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state. If your employer does. Total Everything Up.

The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. An example of the various taxes that can be. Gross pay is the total amount of money an employee receives before taxes and deductions are taken out.

Termination of the QPRT. On his days off you can find him. Estate or gift taxes apply to me my estate or an estate for which I am an executor trustee or representative.

Thirty-five years of racist housing policy. However the grantors estate will receive full credit for any tax consequences of the initial gift to the QPRT and the grantor is no worse off than if he or she had not created the QPRT. We welcome your comments about this publication and your suggestions for future editions.

These are contributions that you make before any taxes are withheld from your paycheck. There may also be contributions toward insurance coverage retirement funds and other optional contributions all of which can lower your final paycheck. You can do a simple calculation 5000 x 12 months to get your gross income.

So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck. Federal government websites often end in gov or mil. If the grantor outlives the term of the trust the residence passes to the beneficiaries at the end of the term.

Theres also the possibility that the calculation only appears incorrect if federal or state withholding amounts on a paycheck are 000. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Texas residents only. Ninety years of Jim Crow.

The most common pre-tax contributions are for retirement accounts such as a 401k or 403b.

Paycheck Calculator Us Apps On Google Play

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

California Paycheck Calculator Smartasset

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Paycheck Calculator Online For Per Pay Period Create W 4

Solved Enter The Hours Worked And Pay Rate For The Employee Chegg Com

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Com Appstore For Android

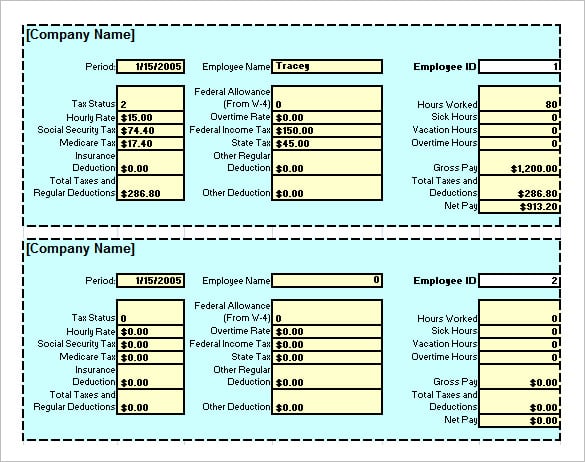

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Free Paycheck Calculator Hourly Salary Usa Dremployee

Understanding Your Paycheck

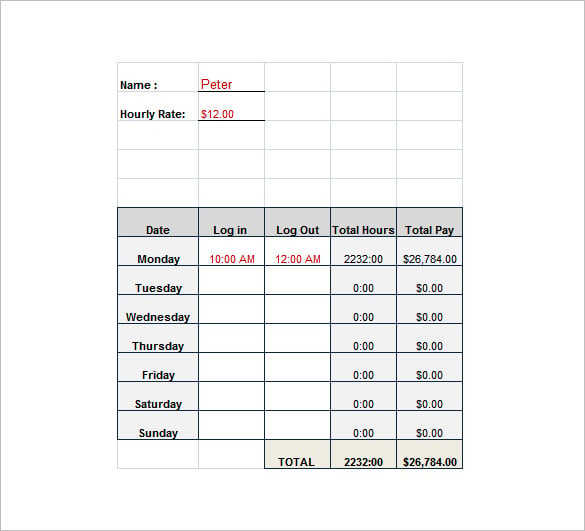

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator